Moody Interviews

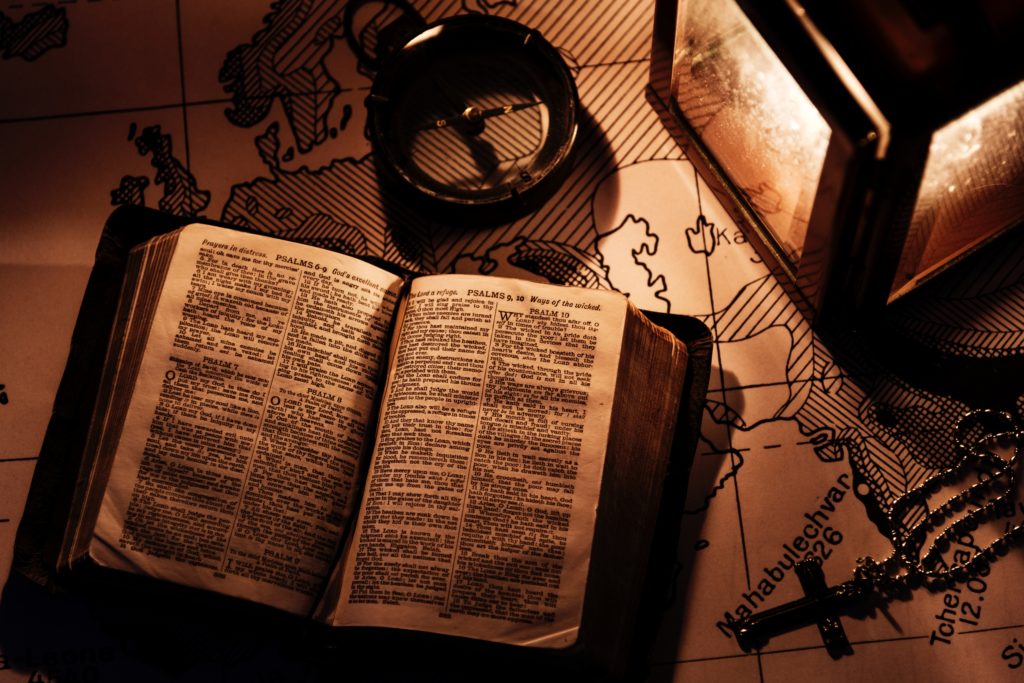

Biblically Responsible Investing

As Christians, how can we make biblically-based investment decisions and steward our resources wisely? Faith-based investing is a growing way to invest your money where your values are. It’s known as Biblically Responsible Investing and has grown in popularity on the idea that how a company makes money and what they do with it is…

Read MoreSocial Security

More and more baby boomers are entering retirement and with that time of life comes the concern about how they continue to pay the bills once they stop working. One of the topics that often comes up in retirement conversations is Social Security. For most people, Social Security is something they haven’t spent much time…

Read MorePracticing Stewardship

In our previous discussion, we concluded that our primary stewardship responsibility is to the gospel message and we can view all of our other resources as tools to be used in that effort to steward the gospel well. We want to pick back up on that topic and look at some specific areas and how…

Read MoreStewardship

For many Christians, when we hear the word “stewardship”, we instantly relate it to the topic of money. In Christian circles, we’ve heard stewardship and money being tied together in many different contexts. It’s typically used in association with capital campaigns, budget conversations and fundraisers. But God’s Word paints a much broader picture of stewardship.…

Read MoreCollege – Income Sharing Agreement

The student loan crisis has finally reached the point that individuals and institutions are both looking for alternatives to debt for funding a college education. One of those new methods being tried out is the Income Sharing Agreement where you trade a percentage of your future income to the school or the lender in exchange…

Read MoreCapping Your Lifestyle

Have you ever taken the time to ask yourself how much is enough? It’s a question we should really all explore from time to time. The world around us seems to be on a never-ending chase for happiness and satisfaction and rarely takes time to sit back and enjoy the things they already have. Today,…

Read MoreHow to Free Up $100 in Your Budget

Who doesn’t want an extra $100 each month? It all starts with tracking our expenses and figuring out where our money is going. Once we’ve done that, we can make decisions on what to cut out of our normal spending in order to free up $100 per month. That money can then be used to…

Read MoreUnderstanding and Repairing our Credit Score

It used to be that our credit score only mattered when we wanted to borrow money, but in recent years, more aspects of our lives are starting to be affected by our credit score, including insurance rates, renting an apartment, even getting a job. Today we want to talk about how we can better understand…

Read MoreMoody Radio Interview – Buying a Car

Our car buying decisions will have a major impact on our overall financial situation. Those that overspend on vehicles will suffer the consequences of spending too much money on depreciating assets. On the other hand, the person that spends within their means will reap the benefits of using their money for better purposes. The following…

Read MoreMoody Radio Interview – Payday Loans

Payday loans often get a bad name because of their high fees, which can often convert to around 400% in interest annually. There is more to the story than just high fee lending though. We need to understand why borrowers use payday loans and also why the lenders charge these high fees. Once we get…

Read More